What does it mean to be a CEO, a Chief Executive Officer? Most people think about a business CEO, but what does it mean to be the CEO of your family’s financial future?

I got to thinking about this last week: it was the end of the quarter and I picked up a report of our corporation for the first three months of this year from my accountant. This gives me information that I need to figure out how we are doing as a company, and many of the same expenses that we take care of here at our office are the same expenses that you might take care of on the home front.

First item on my report is revenue. If we’re talking about the home front, that is income. Then there are expenses. Business expenses could be things like utilities, telephone, freight and postage, bank charges, advertising and promotions, repairs and maintenance, educational expenses, Social Security taxes, state taxes, federal taxes, depreciation, rent or mortgage, legal and accounting expenses, licenses, dues, subscriptions, and travel expenses. Every, single quarter, I get a breakdown on the money that is going in (revenue), and the money going out (expenses). Businesses use these reports or something similar to determine if they are a profitable business.

That same reasoning should go hand-in-hand when you are your family’s CEO. A lot of people get frustrated being in this position because they feel like they are not keeping up with their expenses. One of the reasons that they aren’t keeping up is because they are not getting a quarterly report like I do. They are not tracking what goes and what goes out.

You have to take responsibility when you are the family CEO. We do this at the office by going through the checkbook on a monthly basis. Most of our expenses are put through a company credit card because it’s more cost efficient. We get some additional points that we can accumulate along the way. Instead of writing out many, many checks, we just write out one check for the list of multiple expenses to the credit card company at the end of the month. We keep track of all of the receipts, and then we share those expenses with our accountant. We make sure to keep track of everything and pay off that credit card monthly, just like you should if you have a personal credit card.

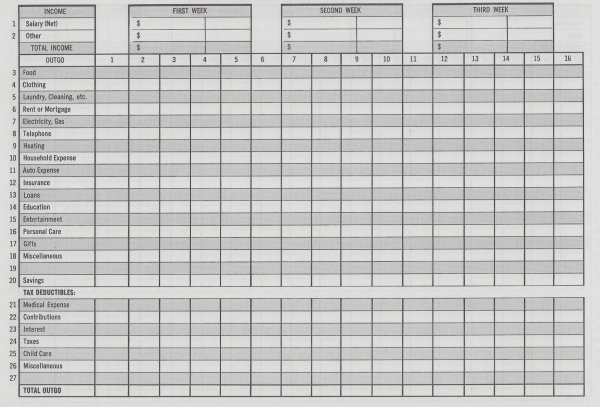

When my spouse and I first got married, we realized that we really did not have our budget under control. We knew what our income was, but we really didn’t have an understanding of our outgoing expenses. Starting back in 1981, we started to fill out a Dome home budget book, which you can still get at Home Depot or online. A lot of people can do all this on a phone app or excel sheet now. However, if you get the book and have to physically write everything out, it really makes the expenses that much more painful.

This may be a bit old-school, but a home budget book will have many of the same things: food, clothing, laundry, rent, mortgage, electricity, gas, telephone, heating, auto, insurance, loans, education, entertainment, personal care, gifts, contributions, interest, taxes, childcare, and additional miscellaneous items. What I like about this particular booklet is that you complete each one of these areas, and then you also fill everything out on a day-to-day basis so you can see exactly where the money is going. You can see what it looks like at the end of the month.

This is the recommendation that I make to people who have never done a budget before: they always think they need to come up with a budget to figure out what they should be spending, I actually believe that it’s best to do several months of what I referred to as “reverse budgeting”. You just keep track of what your expenses actually are for at least a few months and write it all down.

Back in the 1980s, we had a particular goal that we wanted to accomplish, and it required us having an understanding of our budget. By doing reverse budgeting, we kept track of what our expenses were as they occurred, day-to-day. It only took a month or two for us to look back into the budget book and realize a problem. We realized we were spending way too much money on going out to eat, then what our income would really allow. Until we actually saw the number, we couldn’t make the adjustment in our lives because we couldn’t see how big of a problem it was.

Treat your family as if it were a business because it is a business. Let's say your last name is Smith. Your family is now the Smith Corporation, and you are the CEO. Run it like a corporation. Look at the income. Look at the expenses going out. If your business is not making or saving between 15-20% of your income that means that there needs to be some adjustments in your lifestyle.

It’s just like going to my accountant on a quarterly basis and reviewing my business checkbook every month. It’s something that you need to do on a monthly basis as well. You need to know and understand your numbers.