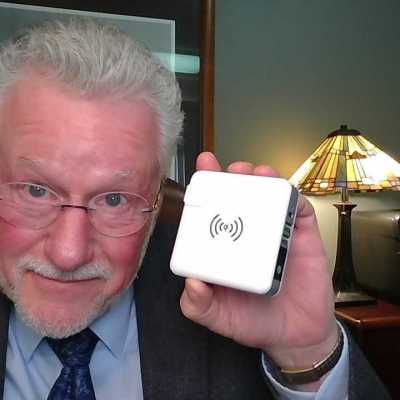

I received this cool little gizmo as a gift a couple of years ago, and it goes on every, single trip that I take. Let me tell you what it does. It holds power so when my phone is dying, I can plug it in and recharge on the go. I'm going ot use this gizmo as an example of how whole life insurance works.

Why am I talking about a power adapter and whole life insurance together? Because of the power that this device holds, but also because it has different kinds of power at different places in my life. For Example, when I’m in the United States, I can simply plug it into an outlet, and it works. But the reason I really like this gizmo is because I can use it all over the world. When I’m traveling overseas, let’s say I am going to Spain, Italy, or France, I can click an adapter into it. Now I can charge it in those countries.

Here’s my analogy. When I’m young, just like this adapter, my life insurance provides a death benefit if I die. That’s the most important thing because if I have a lot of debt, and especially if I have a family, I want to make certain that they can live a good life after I’m gone. So, the death benefit becomes the most important thing.

Later on in life, let’s say I started a business and now I need the resources of the cash value inside the life insurance policy. I’m going to switch my adapter out to this two-prong adapter for Italy. Now, I can use that cash build-up for business opportunities or for emergencies that come my way. My whole life policy or gizmo has the same power inside, but I’m using it in a unique way.

Let’s say I’m going to the UK next. They have their own little adapter that kind of looks like a dryer plug. This adapter reminds me of the money that builds up income tax-deferred and, if used properly with a whole life insurance policy, can be income tax-free at death, OR, I can use it as an income stream later in life. Same power, different usage.

I have one more adapter here that I’ve never used, and I think this is maybe for Australia. This adapter allows me to use my whole life policy as a legacy. What do I mean by legacy? My whole life policy has money available so I can live my life as fully as possible, and I’m planning on living for a long, long time, but someday I’m going to be taking the big trip or the dirt nap. My whole life insurance policy will then have the power to allow my loved ones to receive my assets or legacy as tax advantageously as possible.

There are so many other assets that don’t have these cool power adapters. My traditional IRA or 401K, which is what the vast majority of people have, will be taxed upon death. My pension might disappear entirely upon my death. But with a whole life insurance policy, I have power adapters for when I’m young, when I’m looking for business opportunities, when I have emergencies, and when I need money for my legacy. My legacy will be enhanced by the power that I purchased and owned my entire life.